A Strategic Insight for Investors, Financial Advisors, and Fund Managers

India in the Global Spotlight

As of mid-2025, India is attracting strong interest from global and domestic investors alike. Amid global economic volatility, India’s stable macro fundamentals, structural reforms, and expanding consumption base have made it a key destination for capital.

From foreign direct investments and venture capital to clean energy and infrastructure, India’s investment spectrum is now broader and deeper. For financial professionals, including mutual fund distributors, portfolio managers, and asset advisors, understanding this evolving landscape is vital.

1. Foreign Direct Investment (FDI): Record Inflows, Sectoral Breadth

India attracted approximately ₹6.72 lakh crore in FDI during FY 2024–25 – an all-time high (equivalent to USD 81.04 billion), growing 14% from the previous year.

Key FDI Contributors

Top source countries: Singapore, Mauritius, the USA, Netherlands, and Japan.

Geographic shift: States like Gujarat, Tamil Nadu, and Uttar Pradesh have emerged as top FDI destinations, offering industry parks, tax breaks, and logistics infrastructure.

2. Foreign Portfolio Investment (FPI): Fluctuations and Fundamentals

Equity Market Trends

- 2023: Net FPI inflow of ₹1.71 lakh crore.

- 2024: Fell to ₹2,026 crore, driven by global rate hikes and profit-booking.

- 2025: Sentiment turning positive. India ranked the most preferred equity market in Asia by Bank of America’s investor survey.

Debt Market Outlook

India’s anticipated inclusion in global bond indices could drive ₹2.1–2.5 lakh crore in inflows over the medium term. Meanwhile, domestic institutions and mutual funds are cushioning equity outflows.

3. Venture Capital and Startups: Robust Recovery

India’s startup ecosystem attracted ₹11.37 lakh crore in venture funding in 2024 (equivalent to USD 13.7 billion), a 40% increase from 2023. India has also emerged as one of the most vibrant startup ecosystems globally, as the 3rd largest startup hub.

Sectoral Breakdown

Over 1,200 deals were closed in 2024, with most being early- and growth-stage transactions.

Exit activity: 62 IPOs in Q1 2025 raised nearly ₹$2.8 billion, providing liquidity to VC/PE funds and increasing investor confidence.

4. Infrastructure & ESG: Capital-Intensive Growth Areas

Infrastructure Push

India’s National Infrastructure Pipeline is mobilizing over ₹116 lakh crore in planned investments by 2030. Key sectors include:

- High-speed expressways

- Metro rail, smart cities

- Data centers and logistics parks

- Industrial corridors

Significant projects include an ₹91,000 crore semiconductor plant by the Tata Group and global partners in Gujarat.

Renewable Energy Boom

- India spent $100 billion on clean energy in 2024.

- Over 18.5 GW of capacity added in FY 2023–24.

- India aims for 500 GW of non-fossil energy by 2030.

Sectors like solar parks, wind corridors, grid upgrades, and green hydrogen are seeing increasing private and foreign capital inflow.

5. Key Drivers of India’s Investment Attractiveness

India also benefits from strong forex reserves (USD 640B+) and moderate inflation (~5%)—creating macroeconomic stability that supports capital inflows.

6. Key Challenges That Require Investor Attention

India ranks 63rd globally on ease of doing business (World Bank 2020 data), with further gains expected through digitized clearances and reduced regulatory touchpoints.

7. India vs Other Emerging Markets (2025 Snapshot)

India leads in FDI inflows, GDP growth, and market depth among its peers. Its strengths lie in both domestic demand and technology-led exports, offering a dual growth story.

8. Strategic Implications for Investors

- Diversification Opportunity: India’s growth story is no longer limited to IT; consider allocation to infra, renewables, banking, and domestic consumption.

- Time-Value of Investing: SIPs and long-term allocations benefit from structural trends and reduce timing risk amid short-term FPI volatility.

- Reform-Linked Sector Focus: Sectors aligned with government priorities (e.g., electronics under PLI, green energy, fintech) offer high potential.

- Use of Mutual Funds: Thematic and sectoral funds provide exposure to emerging opportunities like infra, ESG, and digital India.

Conclusion: India as a Core Allocation, Not a Niche Bet

India’s 2025 investment story is built on more than just growth. It’s underpinned by demographic strength, institutional reform, global supply chain repositioning, and a pivot to sustainability. As both developed and emerging market investors seek stable returns in an uncertain world, India offers a compelling mix of scale, resilience, and reform.

Global capital is no longer treating India as a frontier experiment—it is being positioned as a core pillar in long-term global portfolios.

Whether through equity mutual funds, sector-specific portfolios, ESG strategies, or long-term SIPs, the opportunities are wide and growing. As always, aligning your strategy with India’s structural growth drivers can make the difference between participating in a trend—and benefiting from a transformation.

Talk to your investment advisor or portfolio strategist today. Position early. Invest wisely. Stay ahead.

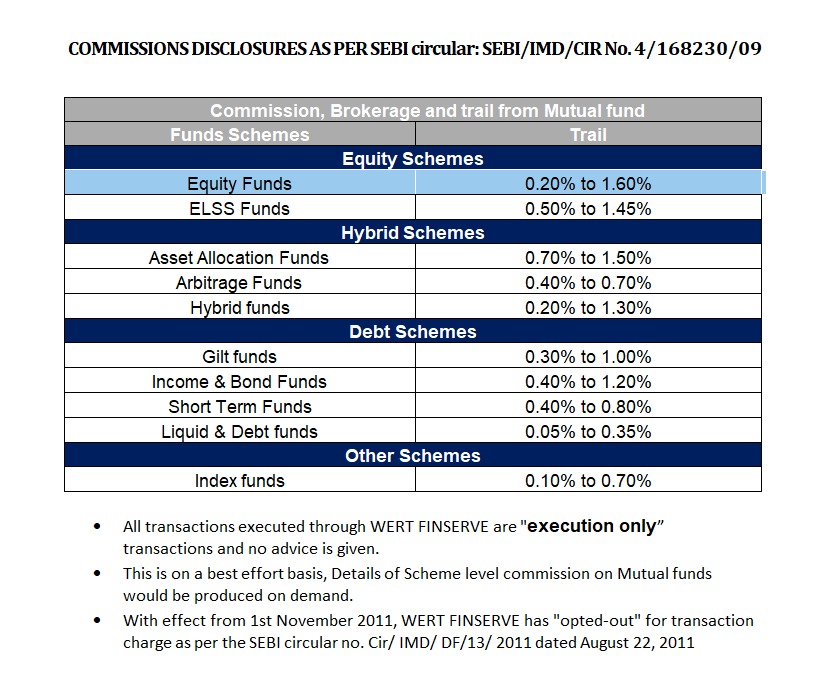

Disclaimer: The information presented in this document is intended for informational and educational purposes only and does not constitute investment advice, solicitation, or recommendation to buy or sell any financial product. While every effort has been made to ensure accuracy, Wert Finserve makes no representations or warranties regarding the completeness or reliability of the data provided. Market conditions are subject to change, and past trends may not continue. Readers are advised to consult a SEBI-registered investment advisor for personalized financial guidance before making any investment decision.